By Judge Lee Sinclair, Faculty Council Chair

You are considering a donation to The National Judicial College. Now you find out that you are no longer going to receive a charitable tax deduction because of the new federal tax plan that took effect in 2018. You want to be charitable, but you still would like some tax relief.

Do not despair. There are still ways to get that tax savings and do some good for your favorite cause.

So, what happened?

The new federal tax law raised the standard deduction to $12,000 for individuals and $24,000 for joint filers. This means that a majority of taxpayers will no longer have enough total deductions to itemize.

From a pure tax standpoint, not being able to itemize means there is no tax benefit to a charitable contribution. A taxpayer can give the contribution but cannot take a corresponding tax deduction.

But all is not lost. One such saving grace is the use of a Qualified Charitable Distribution. A QCD is a distribution from a tax-deferred IRA directly to an eligible charity so that the owner of the account is not taxed on the distribution. It can be tax nirvana.

A QCD is subject to specific requirements, the biggest being the taxpayer must be age 70½ or older. If you are, the tax benefits can be substantial.

A QCD is better than a tax deduction because the donated amount is never reported as income in the first place. It is a dollar-for-dollar reduction in reportable income. This is a major tax savings.

The tax benefit is the same regardless of whether the taxpayer itemizes deductions. Further, the QCD amount counts toward the donor’s required minimum distribution from several types of tax-deferred retirement accounts.

Anyone making a charitable contribution who is over age 70½ should determine if a QCD applies to their situation. If it does, it is foolish not to make the contribution as a QCD.

These are the specific requirements to be eligible to make a Qualified Charitable Distribution:

- The taxpayer must be age 70½ or older when the contribution is made.

- The taxpayer must be the owner of a tax-deferred IRA. Roth IRA plans are not involved because these have already been taxed. A 401(k) plan is not applicable, but a 401(k) converted to an IRA is acceptable.

- The contribution amount must be paid from the IRA custodian directly to the charity. The check must be payable to the charity, not the taxpayer. The taxpayer may present the check, but it must be cut by the custodian directly to the charity.

- The charity or nonprofit must qualify under 501(c)(3) requirements.

- The annual maximum contribution is $100,000.

- The QCD may be used to satisfy all or part of the required minimum distribution from the IRA accounts of the taxpayer. The taxpayer can satisfy all or part of the required minimum distribution up to the $100,000 contribution limit. As an example, if the required distribution was $125,000, the taxpayer could make a QCD contribution of up to $100,000, and the donor would then declare only $25,000 in income for tax purposes, not the full amount of $125,000 received. Without the QCD, the taxpayer would need to declare $125,000 as income. The QCD is a dollar-for-dollar reduction in the taxable amount of the required IRA distribution. It is not a tax deduction, it is an income reduction!

Two examples will illustrate the tax savings potential of the QCD:

Consider Judge A., who wants to donate $2,000 to the NJC. At age 71 she is required to take $10,000 from her IRA in the current year, and this will generate a $10,000 income addition on her tax return. Judge A sends a check from her checking account to the NJC for $2,000. Under the new law, Judge A does not have sufficient deductions to itemize. At tax filing, Judge A receives no charitable deduction or any other tax benefit for her $2,000 donation. All she needed to do was have the check go directly to the NJC from the IRA custodian. This would have reduced her taxable IRA income to $8,000. This simple step would have saved $2,000 in taxable income.

The second example is Judge B. He is 73 and has an IRA that requires he take a minimum distribution of $40,000. Instead of taking a check for the full amount, Judge B directs the custodian to cut a QCD check directly to the NJC for $30,000. This effectively reduces Judge B’s taxable income attributed to the IRA from $40,000 to $10,000. It is an income reduction, dollar-for-dollar. It does not matter whether Judge B itemizes his deductions. Also, if Judge B has other income, the significant reduction in taxable income may keep Judge B out of a higher tax bracket. Finally, there is a great intangible benefit: The custodian can cut the check to the NJC and give it to Judge B. Now Judge B can come to Reno and present the check. Here he will certainly receive a warm, thankful handshake from President Aldana and the staff. In reality, President Aldana will probably shake his hand more than once. A great day for everyone!

The Qualified Charitable Distribution is a viable tool for judges 70½ and older who wish to support the NJC. Consult a tax adviser. Do some good for the NJC and save taxes at the same time.

RENO, NV (PNS) – As they eye their inaugural football season this fall, the Gaveliers have question marks...

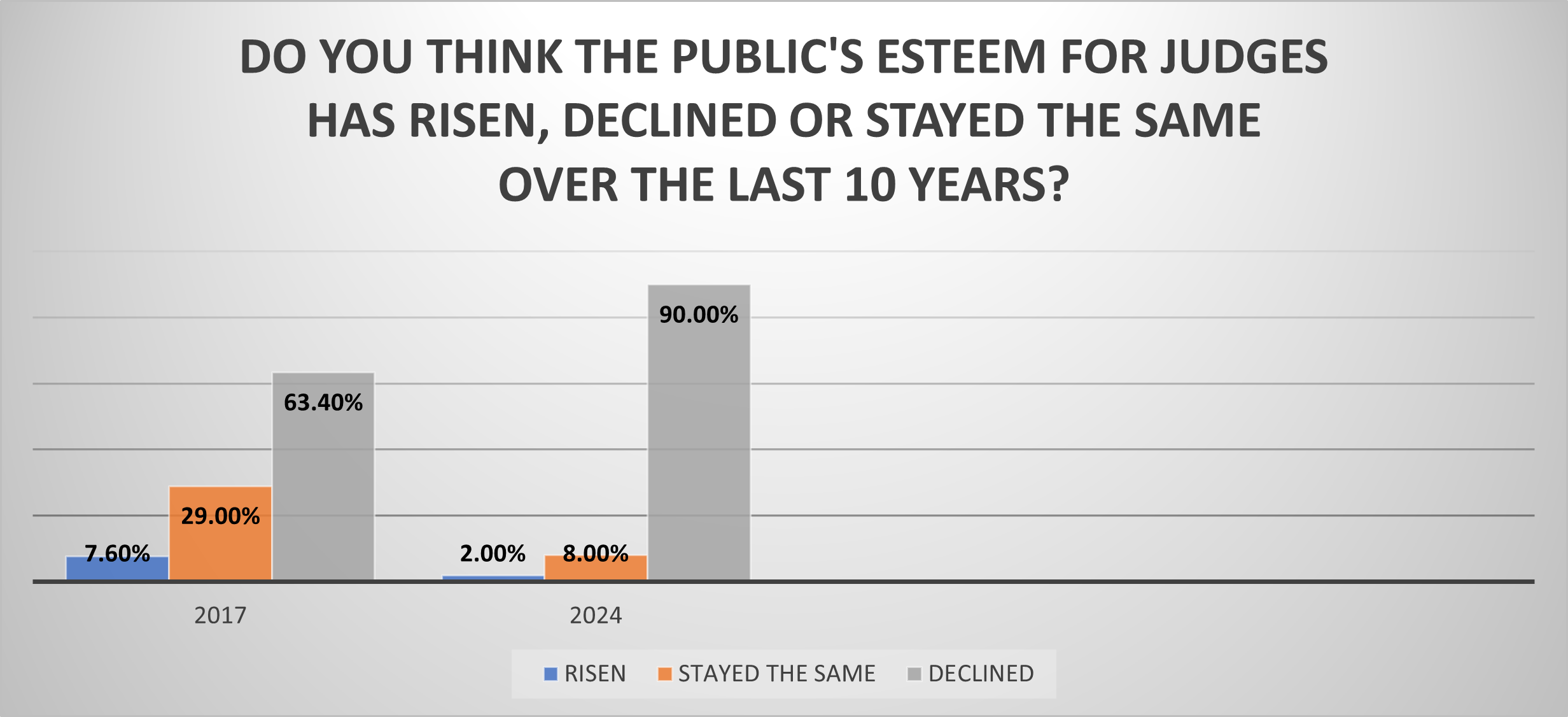

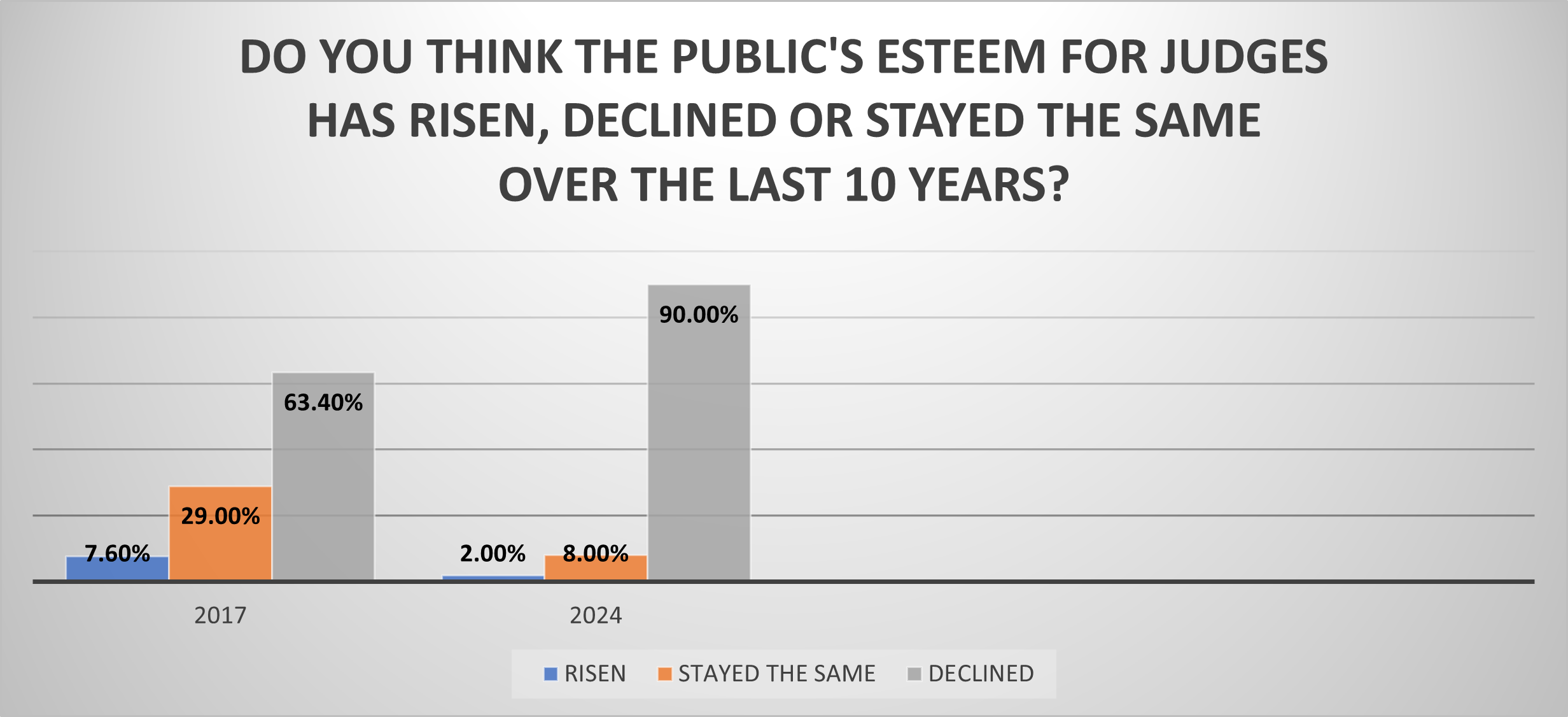

RENO, Nev. (March 8, 2024) — In what may reflect a devastating blow to the morale of the judiciary, 9 out...

In what may reflect a devastating blow to the morale of the judiciary, 9 out of 10 judges believe the publi...

RENO, Nev. (Jan. 26, 2024) — The nation’s oldest, largest and most widely attended school for judges �...

RENO, Nev. (Feb. 7, 2024) — National Judicial College President & CEO Benes Z. Aldana received the Am...