In judicial-foreclosure states, better judicial supervision of mortgage-foreclosure cases can prevent zombie foreclosures, lessen blight, and improve neighborhoods.

A zombie foreclosure occurs when a mortgage-foreclosure case in litigation becomes stalled without good reason. The defendant/owner/mortgagor hasn’t filed for bankruptcy, isn’t seeking loan modification, and hasn’t been deployed for the armed services. The lender that started the case simply isn’t proceeding diligently to conclude the case. The lien of the mortgage, and the stalled or slow-moving lawsuit, cloud title, thereby paralyzing the parcel into a zombie state where neither the plaintiff/lender/mortgagee nor the defendant/owner/mortgagor is maintaining or repairing the parcel.

The foreclosure case is not finished and the lender doesn’t own the parcel yet, so the lender isn’t repairing or maintaining, or assuming owner duties. And the owner/defendant who couldn’t afford the mortgage loan can’t afford to repair, maintain, or put money into a home he thinks he has lost or will lose to foreclosure anyway. The parcel falls into disrepair, and becomes a blighting influence on the block and the neighborhood. If the owner in a stalled foreclosure case moves out and abandons the parcel, the zombie problem worsens. The downward spiral in the physical condition of the house and the blight become even more pronounced.

Judges play a critical role in this process. As supervisor of the litigation before them, judges can take simple steps to net huge neighborhood-improving results. They can ensure that the plaintiff/lender/lawyers move the case along to completion. They can require periodic scheduling conferences or status reports from the lender lawyers to ensure that the case is progressing. Those simple steps, inherent in the court’s power to control court dockets and manage cases, will have huge impact on the parcel, its physical condition, the neighbors, and the neighborhood. Judges can simply reinforce the rules of professional conduct that the plaintiff/lender/lawyers must follow; to, in good faith, diligently pursue and advance the lawsuit that they filed to actual completion and to refrain from acting in a way that causes harm to others or unnecessary delay. The ABA Model Rules of Professional Conduct require lawyers to act with reasonable diligence and promptness in representing the client (Rule 1.3), to make reasonable efforts to expedite litigation consistent with client interests (Rule 3.2), and to not use means aimed at causing delay or burden to third persons (Rule 4.4).

The Milwaukee County, Wisconsin Circuit Court, and Judge Nancy Margaret Russo in the Cuyahoga County, Ohio Common Pleas Court have adopted measures mandating periodic scheduling conferences to ensure that mortgage-foreclosure cases advance and don’t stall. Judge Russo said, “it works. We move properties fast…neighborhoods are safer.”

While each state’s mortgage-foreclosure law is unique, there are commonalities. The lender lawyer files a foreclosure complaint, the lender gets a judgment of foreclosure, the judgment starts a redemption period in which the owner can pay off the loan to stop the foreclosure, and if the owner doesn’t redeem, the parcel gets scheduled for auction or sheriff sale, and the parcel is sold to the high bidder. The Court confirms the sale, and a sheriff or foreclosure deed gets issued to the buyer.

Note the anomaly. Unlike other litigation where the judgment ends the case, in mortgage-foreclosure litigation, the judgment doesn’t end the case. There are post-judgment steps to accomplish (wait-out redemption, sheriff auction, confirmation of sale, deed) before the case can come to a true end when the sheriff or foreclosure deed gets issued.

In distressed urban neighborhoods, where home values and conditions have declined, lenders and their mortgage servicing companies can have incentive to bring foreclosure cases to induce redemption (loan payoff). If the case filing, however, doesn’t result in loan pay-off, they also have incentive to not finish the case. Lenders don’t necessarily want to own the homes (they don’t want to add “REO,” bank-owned, parcels to their inventory) because if the lenders own, they do have to maintain, repair, manage, and sell. While lenders don’t have to bid at the sheriff sale or foreclosure auction, if it is unlikely that there will be bidders who will bid an amount to reasonably minimize the lenders’ loss, the lenders sometimes freeze, and put the foreclosure litigation on hold, zombie-izing the parcel and the foreclosure case.

It is at this point, in the post-judgment, post-redemption period, when the court can step in with the simple steps to stop the zombie state. The court should require the lender lawyer to advance the case and schedule the post-judgment auction sale. If no one wishes to bid, then the lender and lender lawyer should move for dismissal of the case, and satisfy the mortgage of record, to finalize the case in that manner, and conclude the litigation and remove the cloud on title. With the cloud removed, and the foreclosure case ended, the defendant/owner/mortgagor is clearly responsible for the parcel.

One way or another, the lender lawyer that invokes the judiciary by filing a foreclosure lawsuit must be held accountable by the court to finish the case, either by consummating the post-judgment duties to get a sheriff or foreclosure deed issued to another who will be responsible for the parcel and its upkeep, or by dismissing the litigation if the lender or third parties don’t want to own the parcel. Requiring case completion by sale or dismissal removes the cloud on title caused by foreclosure.

Better judicial supervision of mortgage-foreclosure cases truly can prevent zombie foreclosures, lessen blight and improve neighborhoods.

After 22 years of teaching judges, Tennessee Senior Judge Don Ash will retire as a regular faculty member a...

This month’s one-question survey* of NJC alumni asked, “How is 2024 shaping up for you and your court?�...

RENO, NV (PNS) – As they eye their inaugural football season this fall, the Gaveliers have question marks...

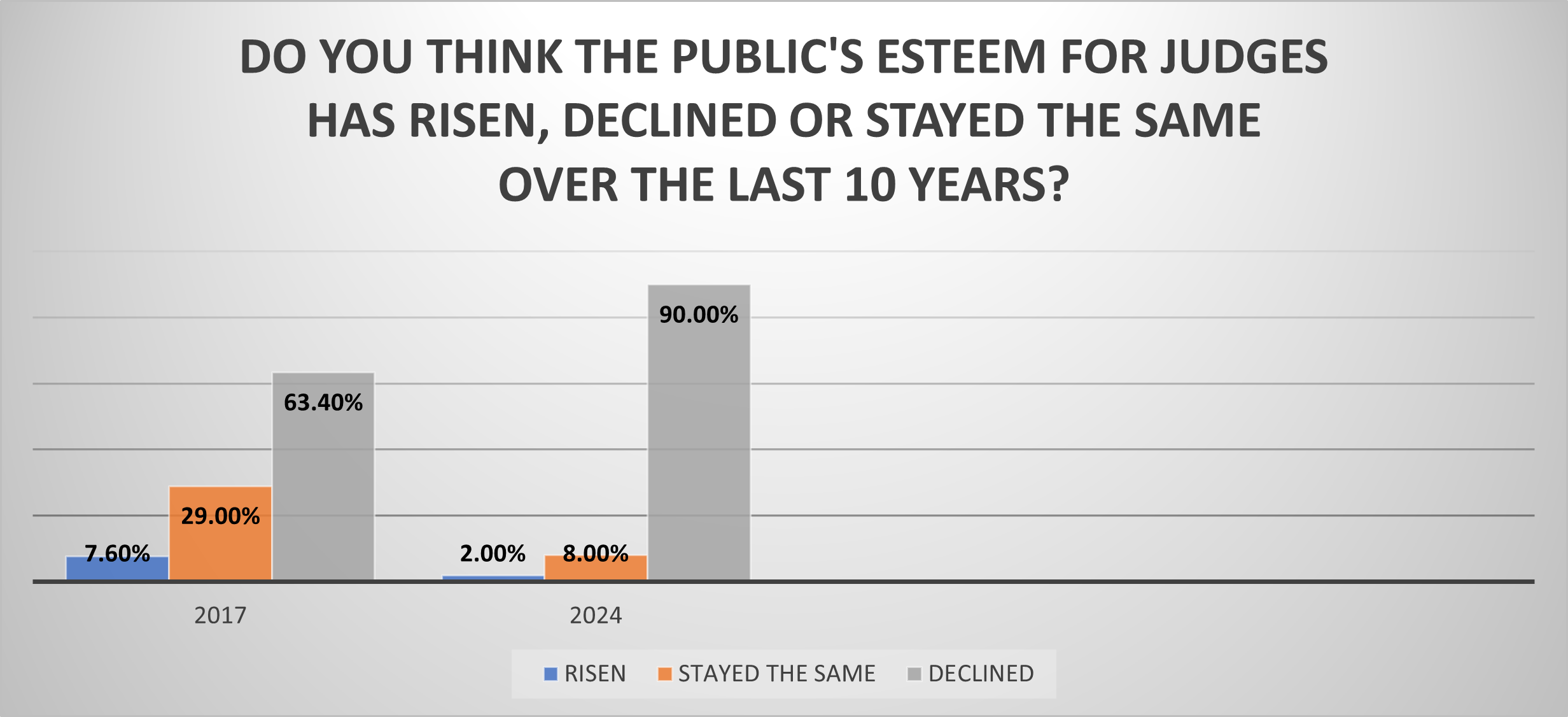

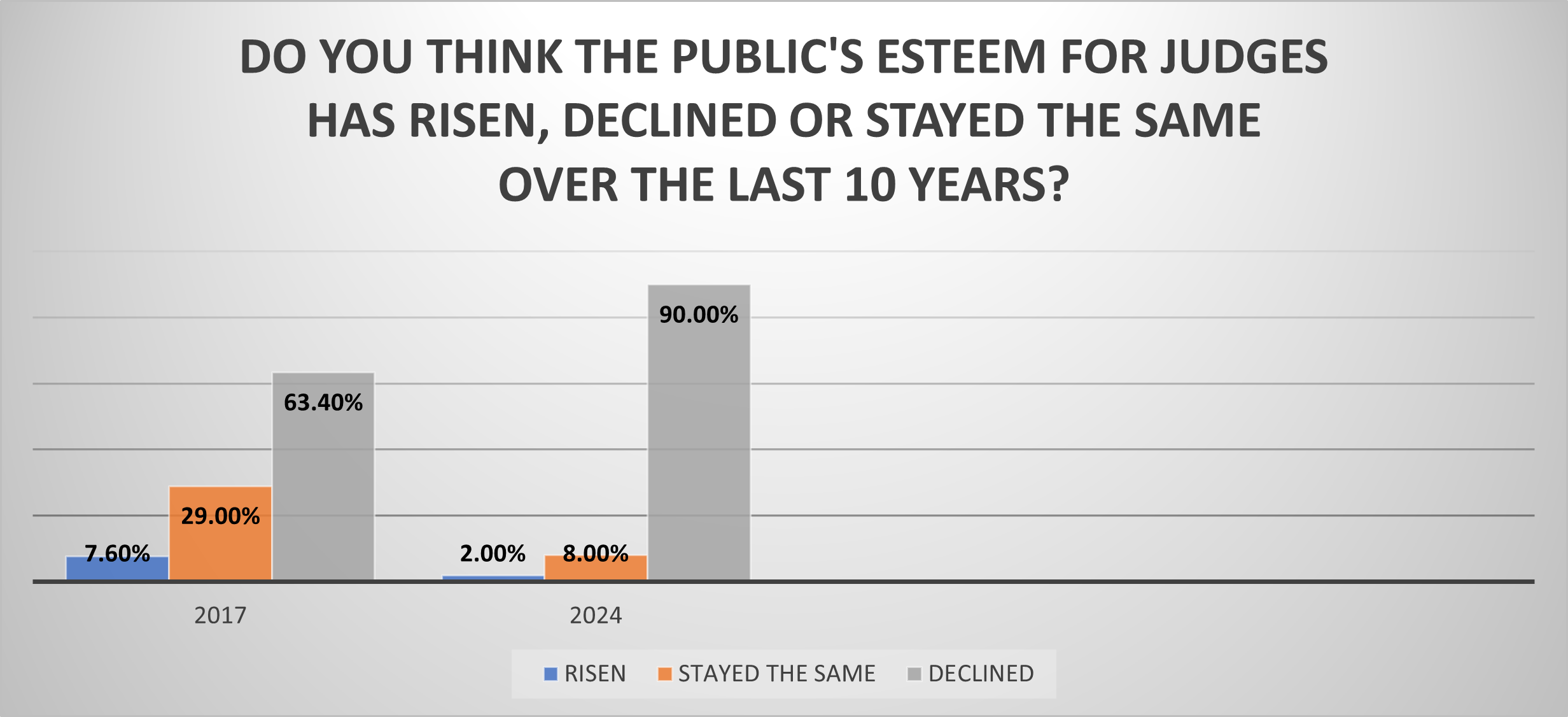

RENO, Nev. (March 8, 2024) — In what may reflect a devastating blow to the morale of the judiciary, 9 out...

In what may reflect a devastating blow to the morale of the judiciary, 9 out of 10 judges believe the publi...